How Online Gambling Is Transforming Personal Finance Strategy in 2026

Digital payments data shows that more adults now track discretionary spending in real time than at any point in the past decade. This shift has changed how people think about money, risk, and daily decision-making. One unexpected influence on this trend comes from online gambling environments, where budgeting and probability are part of every choice.

As platforms evolve, many users are approaching play with the same mindset they apply to personal finance tools. Services such as mz play sit within a growing ecosystem where users monitor balances, set limits, and evaluate outcomes. For a segment of disciplined players, gambling has become a controlled space to practice financial habits rather than a break from them.

From Entertainment to Structured Decision-Making

By 2026, the conversation has moved beyond pure risk warnings. For many, the platform is part of a broader financial learning journey, where careful play supports smarter money choices in everyday life.

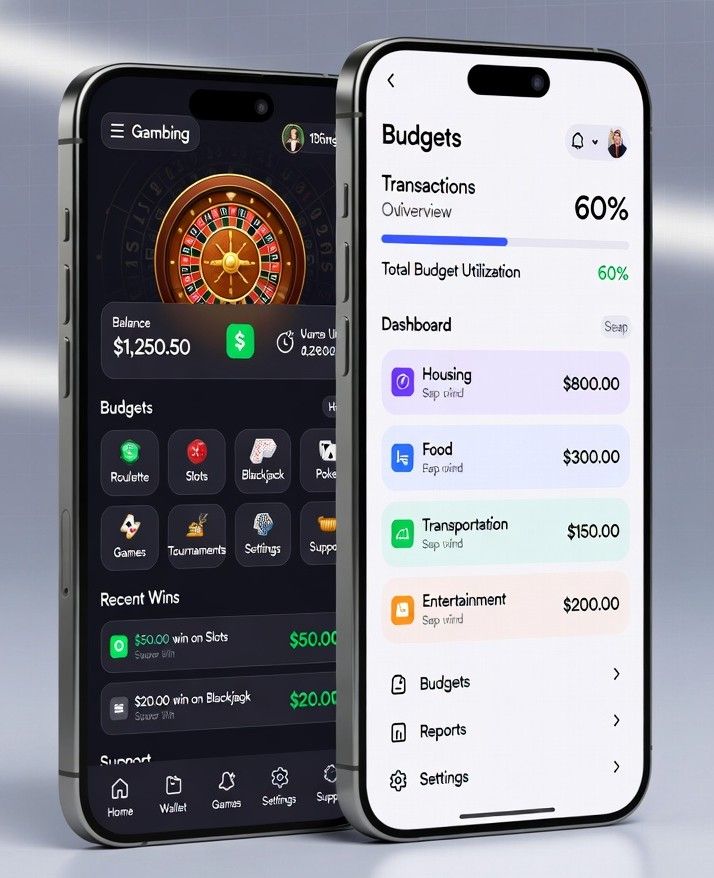

Online gambling in 2026 looks different from the casual play of earlier years. Dashboards show spending history, win ratios, and session summaries. These features mirror budgeting apps used for household expenses. Players who engage thoughtfully learn to pause, assess available funds, and decide whether the potential return matches the risk.

This process reinforces a simple rule that applies far beyond gaming, never risk money you cannot afford to lose. Repeating this logic across many small decisions helps users internalize financial boundaries. Over time, those boundaries can carry into everyday spending, from dining out to online shopping.

Bankroll Management as a Financial Skill

Bankroll management is a term borrowed from professional gaming, but its principles resemble classic money management advice. Players divide funds into portions, plan session limits, and avoid chasing losses. Each step requires discipline and emotional control.

These habits align closely with personal finance best practices. Setting aside a fixed amount for entertainment mirrors allocating funds for travel or hobbies. Tracking results encourages reflection and adjustment. When losses happen, users learn to stop and review, a response that is useful when markets dip or unexpected bills arrive.

Data Awareness Shapes Smarter Choices

Modern platforms generate detailed feedback. Win rates, game volatility, and historical performance are presented clearly. Players who pay attention develop comfort with data-driven thinking. They start to understand variance, expected value, and long-term trends.

This analytical mindset supports better financial planning elsewhere. Instead of reacting to a single outcome, users learn to look at patterns. That approach helps when evaluating investment options, subscription costs, or savings goals. The lesson is simple, short-term swings matter less than consistent strategy.

Why Transparency Builds Financial Confidence

Transparency has become a key factor for financially conscious players. Clear rules, visible odds, and accessible transaction records allow users to stay in control. Insights into how D333 is changing the way players manage money in online gambling show how platforms with transparent mechanics can push users toward smarter decisions. Platforms that explain mechanics openly encourage trust and informed participation.

Within the mz play ecosystem, transparent systems make it easier for users to treat gaming as a managed activity. When people know how outcomes are calculated and where money flows, they can make calmer decisions. That clarity reduces impulsive behavior and supports long-term thinking.

Gaming as a Learning Environment

Some players now view outcomes as feedback rather than judgment. Wins confirm that a strategy works. Losses highlight where limits were tested or assumptions failed. This learning loop feels familiar to anyone who has adjusted a budget after overspending.

By treating results as information, users remove emotion from the process. That mindset is valuable across personal finance. It encourages review, refinement, and patience. Gambling platforms, when used responsibly, can function as low-stakes classrooms for understanding risk and reward.

A Broader Shift in Financial Culture

The blending of gaming and finance reflects a wider cultural change. Younger adults are comfortable managing money through apps and dashboards. They expect instant feedback and clear metrics. Online gambling platforms fit naturally into this digital landscape.

When approached with discipline, these environments reinforce budgeting skills, risk awareness, and data literacy. They remind users that every financial decision involves trade-offs. Entertainment becomes structured, and structure supports better habits.

By 2026, the conversation has moved beyond pure risk warnings. For many, the platform is part of a broader financial learning journey, where careful play supports smarter money choices in everyday life.

Odds are more than numbers on a screen. They give bettors a clear picture of risk and reward, which can directly affect spending habits. Many Brazilian users report that learning to read odds helps them avoid impulsive bets and focus on calculated decisions. This knowledge transforms betting from a gamble into a controlled form of entertainment.

Odds are more than numbers on a screen. They give bettors a clear picture of risk and reward, which can directly affect spending habits. Many Brazilian users report that learning to read odds helps them avoid impulsive bets and focus on calculated decisions. This knowledge transforms betting from a gamble into a controlled form of entertainment.

Sports betting has grown rapidly, fueled by easy access through mobile apps and websites. Yet, for many, the excitement can quickly become a financial risk if not cautiously approached. Whether you’re a novice bettor or a seasoned one, understanding the financial side of sports betting is essential to protecting yourself from significant losses.

Sports betting has grown rapidly, fueled by easy access through mobile apps and websites. Yet, for many, the excitement can quickly become a financial risk if not cautiously approached. Whether you’re a novice bettor or a seasoned one, understanding the financial side of sports betting is essential to protecting yourself from significant losses.

You have a background that comes from the Christian faith or pagan beliefs, for example. The destruction of ceramic tableware before the wedding is well known. This is to drive out the spirits that could bring bad luck to the marriage. This theory cannot be proven; popular belief has nevertheless established itself.

You have a background that comes from the Christian faith or pagan beliefs, for example. The destruction of ceramic tableware before the wedding is well known. This is to drive out the spirits that could bring bad luck to the marriage. This theory cannot be proven; popular belief has nevertheless established itself.